How To Change Payment Method On Iphone 6 Plus

Apple Pay Overview

Contents

- Apple Pay Overview

- Setting Up Apple Pay

- How It Works

- In More Detail

- Apple Pay on the Web

- Peer-to-peer Apple Pay Payments

- The Apple Card

- International Expansion

- Competition

- Apple Pay Timeline

Apple Pay is Apple's mobile payments service. As with the Apple Watch, Apple has adopted the Apple symbol "" followed by "Pay" for the service's name, though the company also refers to it as "Apple Pay."

Available since October 20, 2014, Apple Pay is designed to allow iPhone 6, 6s, 6, 7, 8, 6 Plus, 6s Plus, 7 Plus, 8 Plus, SE, X, XS, XS Max, XR, iPhone 11, iPhone 12, and iPhone 13 users in the United States, the United Kingdom, Australia, Canada, Singapore, Switzerland, Hong Kong, France, Russia, China, Macau, Japan, New Zealand, Spain, Taiwan, Ireland, Italy, Denmark, Finland, Sweden, UAE, Brazil, Ukraine, Norway, Poland, Belgium, Kazakhstan, Germany, Saudi Arabia, South Africa, Austria, the Czech Republic, Iceland, Hungary, Luxembourg, The Netherlands, Bulgaria, Croatia, Georgia, Cyprus, Estonia, Greece, Latvia, Liechtenstein, Lithuania, Malta, Portugal, Romania, Slovakia, Slovenia, Belarus, Serbia, Mexico, Israel, Qatar, Chile, Bahrain, Palestine, Azerbaijan, Costa Rica, and Colombia to make payments for goods and services with their iPhones in retail stores using an NFC chip built into their iPhones.

With the Apple Watch, Apple Pay also extends to the iPhone 5, iPhone 5c, and iPhone 5s. To use Apple Pay with one of these devices, a paired Apple Watch is required to make the payment. This is made possible through the NFC chip included in the Apple Watch. The Apple Watch can also make payments when paired with newer iPhones, so you don't need to pull your phone out to use the payments service.

Apple Pay also lets users make one-tap purchases within apps that have adopted the Apple Pay API, and it is available on the web on devices running iOS 10 or macOS Sierra or later. Devices capable of using Apple Pay within iOS apps or on the web include the iPhone 6 and later, iPad Air 2 and later, iPad mini 3 and later, iPad Pro models, and Macs with Touch ID. All of these devices feature Touch ID or Face ID and contain an NFC controller where the "Secure Element" of Apple Pay is located, keeping customer information private.

In 2017, Apple enabled person-to-person Apple Pay payments through the Messages app on the iPhone and Apple Watch. Using Apple Cash, you can send money to friends or family in the United States. Apple in August also introduced its own credit card, the Apple Card, which has unique perks and benefits and offers deep integration with Apple Pay and the Wallet app.

Apple Pay has seen a major change with the introduction of the iPhone X and later as these iPhones feature Face ID facial recognition instead of Touch ID fingerprint authentication. Facial scans rather than fingerprint scans are used to confirm payments on the new device.

To keep transactions secure, Apple uses a method known as "tokenization," preventing actual credit card numbers from being sent over the air. Apple also secures payments using Touch ID or Face ID on compatible iPhones and continual skin contact on the Apple Watch.

Apple is aiming to replace the wallet with Apple Pay, and the one-step payment process prevents people from needing to dig through a purse or wallet to find credit or debit cards. Because it is built on existing NFC technology, Apple Pay works anywhere NFC-based contactless payments are accepted.

As of 2019, Apple Pay has overtaken Starbucks to become the most popular mobile payment platform in the United States, and it is on track to account for 10 percent of global card transactions by 2025.

Note: See an error in this roundup or want to offer feedback? Send us an email here.

Setting Up Apple Pay

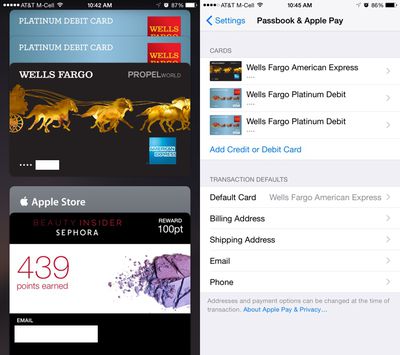

After installing iOS 8.1 or later, Apple Pay can be set up in the Wallet app. Tapping the "+" icon in Wallet lets users to add a credit or debit card to Apple Pay, either selecting a card already on file with iTunes or scanning one in with the camera. Apple Pay can also be set up by using the prompts when setting up a new iPhone, iPad, or Mac.

Credit and debit cards are verified in just a few seconds, but some cards require a phone call, app download, or an email to verify a card before it can be added to Apple Pay. Once a card is verified, it is immediately available for purchases both in stores and within apps. Up to eight cards can be registered with Apple Pay at one time.

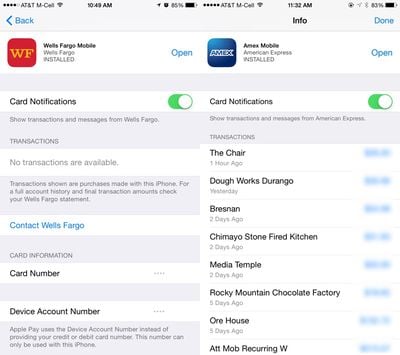

Apple Pay can be managed in the Settings app, located in the "Wallet and Apple Pay" section. Each card added to Wallet is listed in that section, along with information like billing address, email, and phone number. Tapping on a card offers specific information like last digits of the card number, last digits of the Device Account Number that replaces the card number in transactions, and it also provides contact information for the bank that issued the card.

Some cards are also able to display transaction information, offering a list of recent transactions that have been made, with Apple Pay or with a traditional purchase via physical card.

Apple Pay How Tos

-

How to Change Your Default Card for Apple Pay Purchases on Your iPhone

-

How to Change Your Default Card for Apple Pay Purchases on Your Apple Watch

-

How to Change Your Default Card for Apple Pay Purchases on Your Mac

How It Works

In a retail store, when approaching a point-of-sale system compatible with Apple Pay, the screen of the iPhone lights up and opens Wallet automatically, where a user can tap on a credit card to be used or pay with the default Apple Pay card.

A payment is made by holding a compatible iPhone or Apple Watch near a checkout system that includes NFC, most of which look like standard card checkout terminals within stores. A finger registered with Touch ID must be kept on the home button for a short amount of time (or the Apple Watch must be kept on the wrist), after which a payment is authenticated and the transaction is completed.

A completed payment is denoted by a slight vibration, a check mark on the screen, and a beep. On devices with Face ID, a facial scan is used in lieu of a fingerprint scan, and a double tap is required on the side button of the device to confirm a payment.

In some stores and in some countries, users may still be asked for a PIN code due to older point-of-sale machines, transaction limitations, and laws in certain countries, but for the most part, checking out with Apple Pay is an easy one-step process that does not require a signature or PIN.

With Apple Pay, a cashier does not see a credit card number, a name, an address, or any other personally identifying information, making it more secure than traditional payment methods. There is no need to take out a credit card or confirm the authenticity of a credit card with a driver's license or ID card, because all of that information is stored on the iPhone and protected by several built-in security systems, including Touch ID.

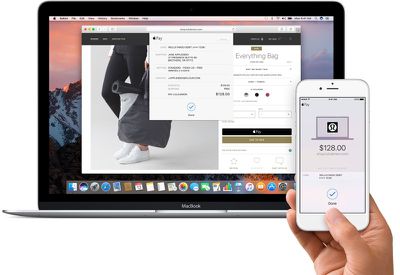

Making a payment online via Apple Pay is just as simple as an in store payment because it uses the same credit card and authenticates with Touch ID in participating apps that have adopted the Apple Pay API. Using Apple Pay in an app or on a website bypasses all of the steps that are usually required when making an online purchase, including entering shipping and payment information.

After an item is added to an online cart and a user initiates the checkout process, Apple Pay can be selected as the payment method. The shipping/billing address associated with the credit or debit card on file is automatically entered, as is a user's name, and the purchase is confirmed via Touch ID. During this process, information like shipping address can be altered, which is useful when ordering a gift. Online payments using Apple Pay for the web follow the same process.

Online and retail store payments are both limited to participating merchants. Apple Pay is only available within apps and on websites that have adopted the Apple Pay API and to make a payment in a retail location, the shop needs to support Apple Pay directly or allow NFC payments.

In More Detail

Compatible Devices

Apple Pay in stores is available for the iPhone 6, 6s, 6 Plus, 6s Plus, SE, 7, 7 Plus, 8, 8 Plus, X, XS, XS Max, XR, 11, 11 Pro, 11 Pro Max, iPhone 12 mini, iPhone 12, iPhone 12 Pro, and iPhone 12 Pro Max, iPhone 13 mini, iPhone 13, iPhone 13 Pro, iPhone 13 Pro Max, all of which contain near-field communication (NFC) chips that have not been incorporated into previous-generation iPhones.

Apple Pay also works with Apple Watch, the company's wrist-worn wearable device. The Apple Watch allows owners of older iPhones, including the iPhone 5, 5c, and 5s, to use Apple Pay in retail stores. Though the Watch needs to be paired with a phone, Apple Pay can be used when the phone is not present.

Security

Apple puts a heavy emphasis on security when advertising Apple Pay, to assure iPhone owners that their payment information is safe, and, in fact, safer on an iPhone than inside of a wallet. According to former credit card executive Tom Noyes, the way Apple Pay has been designed to work makes it "the most secure payments scheme on the planet."

When a credit or debit card is scanned into Wallet for use with Apple Pay, it is assigned a unique Device Account Number, or "token," which is stored in the phone rather than an actual card number.

The iPhone itself has a special dedicated chip called a Secure Element that contains all of a user's payment information, and credit card numbers and data are never uploaded to iCloud or Apple's servers. When a transaction is made, the Device Account Number is sent via NFC, along with a dynamic security code unique to each transaction, both of which are used to verify a successful payment. The dynamic security code is a one-time use cryptogram that replaces the credit card's CCV and is used to ensure that a transaction is being conducted from the device containing the Device Account Number.

Dynamic security codes and Device Account Numbers (aka, tokens and cryptograms) are not unique to Apple and are built into the NFC specification that the company is adopting. In fact, much of the Apple Pay system is built on existing technology.

Along with Device Account Numbers and dynamic security codes, Apple also authenticates each transaction through Touch ID or Face ID. Whenever a transaction is conducted with an iPhone, a user must place a finger on Touch ID or complete a facial scan for the payment to go through.

With the Apple Watch, authentication is done through skin contact. When the watch is placed on the wrist, a user is prompted to enter their passcode. After a passcode is entered, as long as the device continues to have contact with the skin (which is monitored through the heart rate sensor), it's be able to be used to make payments. If the watch is removed and skin contact is lost, it can no longer be used to make payments.

Both Touch ID, Face ID, and the skin contact authentication method in the Apple Watch prevent someone who has stolen an iPhone or Apple Watch from making an unauthorized payment.

Because Apple utilizes Device Account Numbers, a user's credit card number is never shared with merchants or transmitted with payments. Store clerks and employees do not see a user's credit card at any point, and they also do not have access to personal information like a name or address because an ID is not required for verification purposes.

Furthermore, if an iPhone is lost, the owner can utilize Find My iPhone to suspend all payments from the device, without needing to go through the hassle of canceling credit cards.

Banks are confident in Apple Pay's security, and have opted to assume liability for any fraudulent purchases made both in retail stores and online using the system.

Privacy

Apple has been careful to point out the company does not store or monitor the transactions that people make with Apple Pay. Apple says it does not know what people are purchasing, nor does it save transaction information.

"We are not in the business of collecting your data," said Eddy Cue during the keynote speech introducing Apple Pay. "Apple doesn't know what you bought, where you bought it, or how much you paid. The transaction is between you, the merchant, and the bank."

U.S. Partners

Compatible Credit Cards and Banks

Apple has partnered with the major credit and debit card companies in the United States: Visa, MasterCard, Discover, and American Express. Apple has also signed deals with major banks, including Bank of America, HSBC, Capital One, Chase, Citi, American Express, and Wells Fargo, plus it has established deals with hundreds of smaller banks across the country.

A current list of bank partners can be found on Apple's participating banks support document.

Store Credit Cards:

In October of 2015, Kohl's became the first retail store to allow Apple Pay to be used with its in-store credit cards. Kohl's Charge Cards can now be added to Apple Pay and used to make purchases in Kohl's retail stores. In May of 2016, Kohl's also became the first retailer to support both store payments and rewards with a single tap in Apple Pay, allowing users to automatically get rewards points when using their Kohl's cards without the need for a second Apple Pay transaction.

BJ's Wholesale Club Credit Cards began working with Apple Pay in December of 2015. JCPenney also began supporting Apple Pay in mid-2017 for its store cards, and other stores have also been implementing rewards into Apple Pay.

Retail Partners:

Because Apple Pay is based on already existing NFC technology, the service works in hundreds of thousands of locations that accept contactless payments in the countries where Apple Pay is accepted. Apple Pay launched with a handful of partners, but over the course of the last two years, many more stores have begun accepting the payments service.

Apple Pay is accepted in more than a million retail stores, restaurants, gas stations, grocery stores, and more across the United States. By the beginning of 2019, Apple Pay was available in 65 percent of U.S. retail locations. 74 of the top 100 merchants in the United States accept Apple Pay.

Some of Apple's partners include Best Buy, B&H Photo, Bloomingdales, Chevron, Disney, Dunkin Donuts, GameStop, Jamba Juice, Kohl's, Lucky, McDonald's, Office Depot, Petco, Sprouts, Staples, KFC, Trader Joe's, Walgreens, Safeway, Costco, Whole Foods, CVS, Target, Publix, Taco Bell, and 7-11.

Transit systems in Philadelphia, Portland, Chicago, New York, Boston, San Diego, Los Angeles, Hong Kong, Toronto, Montreal, Washington, D.C., San Francisco, and 275 cities in China have added support for Apple Pay, with a list of states, countries, and regions that support Apple Pay for transit available here.

Apple Pay can be used to pay for transit on iPhone and Apple Watch, and in many of the above listed areas, Express Transit Mode is available. With Express Transit Mode, the iPhone and Apple Watch can be used to quickly pay for rides without having to unlock the device, open an app, or validate with Face ID/Touch ID.

Apple Pay is also available in many places outside of traditional retail stores, including universities, ballparks, non-profit organizations, Bitcoin payment providers, and even ATMs from Bank of America, Chase, and Wells Fargo.

A full list of locations where Apple Pay is accepted in the United States can be found on Apple's Apple Pay website.

Apps:

Apple Pay support can be built into any app, and thousands of apps, representing businesses both big and small, accept Apple Pay as a payment method in their apps. When used in an app, Apple Pay payments can be made on iPhones and iPads equipped with Touch ID fingerprint sensors.

Apple Pay Loyalty Card Integration

In the fall of 2015, Apple Pay began working with various store loyalty programs, allowing customers with loyalty cards stored in the Wallet app to use them over NFC in participating stores. Loyalty cards from eligible stores added to Wallet pop up at NFC terminals just like credit cards.

Walgreens was the first company to support the Apple Pay loyalty program. Walgreens customers can add their Walgreens rewards cards to Wallet where they can be used like any other credit or debit card during the checkout process to earn rewards points.

Checking out with a rewards card is a two-step process in most stores -- first it's necessary to activate the rewards card with a finger on Touch ID, followed by the actual payment. Kohl's is an exception, having introduced one-touch rewards and payment integration.

Goldman Sachs Partnership

Apple and Goldman Sachs partnered to launch credit card called Apple Card that features Apple Pay branding and offers two percent cash back on Apple Pay purchases. Goldman Sachs replaced Barclays as Apple's financing partner, and Apple Card also offers financing options for Apple products in addition to cash bonuses for Apple Pay purchases. The Apple Card is limited to the United States at the current time.

Apple's Cut

Apple collects a fee from banks each time consumers use the Apple Pay payment solution to make a purchase. According to rumors, Apple has struck individual deals with each bank it has partnered with, including Chase, Bank of America, Wells Fargo, and more.

Apple's cut is reportedly at approximately 0.15 percent of each purchase, which equates to 15 cents out of each $100 purchase.

Apple Pay on the Web

With iOS 10 and macOS Sierra, Apple Pay expanded to websites. Participating websites have begun offering Apple Pay as a payment option when checking out, giving Apple Pay users an alternative to payments services like PayPal. Many websites and payment providers like Stripe, WePay, and SquareSpace support Apple Pay on the web.

On Macs with a Touch Bar, purchases are verified through Touch ID. On other machines, purchases are verified through a connection to an Apple Watch or an iPhone, with the purchase authorized via Touch ID/Face ID, and on the iPhone and iPad, purchases are authorized through Touch ID (or Face ID on iPhone X) as normal.

Peer-to-peer Apple Pay Payments

In iOS 11.2, Apple introduced Apple Cash (formerly Apple Pay Cash), designed to allow users to send peer-to-peer Apple Pay payments using Messages on the iPhone, iPad, and Apple Watch. Apple Cash lets you send money to friends and family with a connected debit card, similar to services like Square Cash or Venmo.

Money can be sent in Messages using standard fingerprint/face authentication (or skin authentication on the Apple Watch), and funds received are available in a new Apple Cash card that's located in Wallet. This card can be used to make Apple Pay purchases where Apple Pay is accepted (similar to any other credit or debit card stored in Apple Pay), or it can be transferred to a bank account. Apple partnered with prepaid card provider Green Dot for the Apple Cash card.

Sending money using Apple Cash via Messages requires an Apple Pay-compatible device, which includes the iPhone SE, iPhone 6 or later, iPad Pro, iPad 5th & 6th generation, iPad Air 2, iPad mini 3 or later, and Apple Watch. Person-to-person payments are limited to the United States at the current time.

Like many peer-to-peer money transferring services, sending money is free when a debit card is used, and while Apple used to allow money to be loaded using a credit card for a small fee, you can now only add money to Apple Cash via a debit card.

Apple Cash is limited to the United States, but could soon expand to several countries in Europe.

According to a recent study by Consumer Reports, Apple Cash is the best peer-to-peer mobile payments service thanks to Apple's robust security and privacy policies. Apple Cash beat out Venmo, Square Cash, Facebook Messenger payments, and Zelle.

The Apple Card

Apple in August 2019 introduced the Apple Card, its own credit card in partnership with Goldman Sachs and Mastercard. The Apple Card is a new physical and digital credit card that iPhone users in the U.S. can sign up for on the iPhone.

Apple Card works like a traditional credit card, but it is deeply integrated into the Wallet app, offering up real-time views of the latest transactions and a complete overview of spending organized by category along with payment options optimized for encouraging minimal interest.

Apple is offering a "Daily Cash" cash back program that gives you 1 percent cash back on all purchases, 2 percent cash back on all Apple Pay purchases made with Apple Card, and 3 percent on all Apple-related purchases at Apple retail stores, the App Store, iTunes, and some third-party partner stores. Daily Cash is immediately available in the Wallet app, delivered on the Apple Cash card.

Apple also offers three percent cash back when using the Apple Card with Apple Pay for Uber, Uber Eats, T-Mobile, Walgreens, Nike, and Duane Reade purchases. In the future, Apple also plans to bring three percent cash back rewards to other merchants and apps.

Customer support for Apple Card is done through the Messages app, and there are no fees associated with the card. Apple is aiming to provide low interest rates, but APR is be based on credit score and credit approval is required. Privacy is a major focus, and the physical Apple Card - made out of titanium engraved with your name - has no number on it, no signature, and no expiration date, with info instead stored in the Wallet app.

We have a full guide with everything that you need to know about Apple Card available here.

International Expansion

UK

On July 13, 2015, Apple Pay expanded beyond the United States for the first time, launching in the United Kingdom. As in the U.S., Visa, MasterCard, and American Express all supported Apple Pay at launch. UK Banks supporting Apple Pay at launch included MBNA, Nationwide, NatWest, Royal Bank of Scotland, Santander, and Ulster Bank. First Direct, HSBC, Clydesdale Bank, Yorkshire Bank, Metro Bank, The Co-Operative Bank, Starling Bank, and digital banking service B added support at a later date.

Apple has a list of all the UK banks that support Apple Pay on its UK Apple Pay site. Most of the major banks in the country support the payments service, including holdout Barclays, which began accepting Apple Pay in April after a long delay.

More than 250,000 locations in support Apple Pay, ranging from fast food places like KFC and McDonald's to shops like Boots, Marks & Spencer, and Waitrose. A full list of retail shops and apps that accept Apple Pay can be found on Apple's website. Many UK-based apps are also accepting Apple Pay, like Zara, TopShop, Five Guys, Hotel Tonight, Miss Selfridge, and more.

British territories Guernsey, Isle of Man, and Jersey also support Apple Pay.

Australia

Apple Pay became available in November of 2015 through a partnership with American Express, allowing American Express cardholders to use Apple Pay at any retailer that accepts contactless payments, but later Visa, Mastercard, and eftpos began supporting Apple Pay. In April of 2016, Apple Pay expanded to ANZ, the first of Australia's four major banks to implement Apple Pay support.

At launch, Australia's Commonwealth Bank (CBA), Westpac, and NAB attempted to engage in collective bargaining with Apple in an effort to force Apple to open up the iPhone's NFC capabilities to support other digital wallets, but the attempt was blocked by the Australian government and as of April 2020, all of the four major banks in Australia support Apple Pay.

Through a partnership with Cuscal, Apple Pay is also available at more than 31 small banks and credit unions, making it available to four million Australians who are customers of those financial institutions. ING Direct and Macquarie have also implemented Apple Pay support, as have HSBC and Bendigo. In April of 2018, Citibank added Apple Pay support in Australia.

A list of retailers that officially support Apple Pay in Australia can be found on the Australian Apple Pay website.

Canada

Apple Pay launched in Canada in November of 2015 through an American Express partnership, allowing American Express cardholders in Canada to use Apple Pay at any retailer that accepts contactless payments.

After debuting through the American Express partnership in 2015, Apple Pay in Canada expanded to two major Canadian banks, RBC and CIBC, on May 10, 2016. Apple Pay further expanded to Canada Trust, Scotiabank, BMO, Tangerine, and MBNA, and with all major Canadian banks accepting Apple Pay, the payments service is available 90 percent of Canadian banking customers.

A list of participating retailers and banks in Canada is available on Apple's Canadian Apple Pay website.

China

Apple Pay launched in China on February 18, 2016, through a partnership with China UnionPay, China's state-run interbank network. China UnionPay card holders with an eligible debit or credit card can use their cards at any location that has a UnionPay-compatible point-of-sale system available. Apple has signed deals with 19 of the biggest lenders in China, making 80 percent of credit and debit cards in China eligible for use with Apple Pay.

Hong Kong

Apple Pay launched in Hong Kong on July 20, 2016, with support for Visa, MasterCard, and American Express debit and credit cards issued by Hang Seng Bank, Bank of China (Hong Kong), DBS Bank (Hong Kong), HSBC, Standard Chartered, Citibank, and directly from American Express. BEA and Tap & Go began accepting Apple Pay shortly after in August of 2016.

Apple Pay retailers in Hong Kong include 7-Eleven, Apple, Colourmix, KFC, Lane Crawford, Mannings, McDonald's, Pacific Coffee, Pizza Hut, Sasa, Senryo, Starbucks, ThreeSixty, and everywhere else contactless payments are accepted.

Macau

Apple Pay launched in Macau, a Special Administrative Region of China, in August 2019. Apple Pay in Macau works with Banco Nacional Ultramarino (BNU) and UnionPay International Hong Kong Branch (UPI).

Singapore

Apple Pay launched in Singapore in April of 2016 through a partnership with American Express. Apple Pay support later expanded to encompass Visa, American Express, and Mastercard credit and debit cards issued by POSB, DBS, OCBC, Standard Chartered, UOB, HSBC, and Citibank. Apple Pay is now available to more than 80 percent of Visa and Mastercard cardholders in the country.

A list of retail locations where Apple Pay is accepted can be found on Apple's Singapore website.

Switzerland

Apple Pay expanded to Switzerland on July 7. Apple Pay is available for MasterCard and Visa credit and debit cards issued by Bonus Card, Cornèr Bank, Swiss Bankers, and UBS.

Apple Pay is accepted at many retailers in Switzerland, including ALDI SUISSE, Apple, Avec, Hublot, K Kiosk, Lidl, Louis Vuitton, Mobilezone, Press & Books, SPAR, TAG Heuer, and everywhere else contactless payments are accepted.

France

Apple Pay expanded to France on July 18, 2016. MasterCard and Visa credit and debit cards issued by Banque Populaire, Ticket Restaurant, Carrefour Banque, Caisse d'Epargne, BNP Paribas, HSBC Bank, Vivid Money, and more are available for use with Apple Pay in the country.

As listed on the Apple Pay France website, Apple Pay is available at a wide range of retailers like Bocage, Le Bon Marché, Cojean, Dior, Louis Vuitton, Fnac, Sephora, Flunch, Parkeon, Pret, and more.

Japan

Apple Pay became available in Japan on October 24, 2016. Apple Pay in Japan works with credit and debit cards issued by American Express, Visa, JCB, Mastercard, Aeon Financial, Orico, Credit Saison, SoftBank, d Card, View Card, MUFG Card, APLUS, EPOS, JACCS, Cedyna, POCKETCARD, Life, and more.

Later this year, Japanese prepaid cards Nanaco and WAON will add support for Apple Pay.

Suica and PASMO transit systems are compatible with Apple Pay and Express Transit mode in Japan, allowing users to pay for transit fares and other transactions with the iPhone or Apple Watch. Many retail locations, shops, restaurants, and other areas in Japan also support Apple Pay, with details on Apple's Japanese Apple Pay website.

Russia

Apple pay expanded to Russia on October 4, 2016, with the payment service available for use with the following financial institutions: Tinkoff Bank, Bank Saint Petersburg, Raiffeisenbank, Yandex.Money, Alfa-Bank, MTS Bank, VTB 24, Rocketbank, MDM Bank, and Mir, Russia's national payment system.

Participating retailers in the country include TAK, Magnit, Media Markt, Auchan, Azbuka Vkusa, bp, M.Video, TsUM and authorized Apple reseller re:Store. A full list is available on Apple's Russian Apple Pay website.

Belarus

Apple Pay launched in Belarus on November 19, available to BPS Sberbank customers who have a Visa or Mastercard. BPS Sberbank is the Belarusian branch of PJSC Sberbank, a atate-owned Russian bank.

New Zealand

Apple Pay launched in New Zealand through a partnership with ANZ on October 12, 2016. Apple Pay initially only worked with credit and debit cards issued by ANZ, but BNZ added support in October of 2017. Westpac later began supporting Apple Pay in 2019.

Apple Pay is available at many locations in New Zealand, including McDonald's, Domino's, Glassons, K-Mart, Hallenstein Brothers, Stevens, Noel Leeming, Storm, and more, with a full list available on the Apple Pay New Zealand website.

Spain

Apple Pay launched in Spain on December 1, 2016. Apple Pay is available to American Express, CaixaBank, ImaginBank, ING, Banco de Santander customers, and credit and debit cards issued by Carrefour and Ticket Restaurant are also accepted.

A full list of Apple Pay retail partners and compatible apps is located on Apple's Spanish website.

Ireland

Apple Pay expanded to Ireland in March of 2017. Apple Pay is available for Visa and MasterCard holders that bank with KBC, Bank of Ireland, Ulster Bank, AIB, Permanent TSB, and more.

Participating retailers in Ireland include Aldi, Amber Oil, Applegreen, Boots, Burger King, Centra, Dunnes Stores, Harvey Norman, Lidl, Marks and Spencers, PostPoint, SuperValu, and more, with a full list of participating retailers available on the Irish Apple Pay website.

Taiwan

Apple Pay launched in Taiwan on March 28, 2017. Apple Pay is available to Visa and MasterCard holders who are customers of Cathay United Bank, CTBC Bank, E. Sun Commercial Bank, Standard Chartered Bank, Taipei Fubon Commercial Bank, Taishin International Bank, and Union Bank of Taiwan.

A list of stores and websites that support Apple Pay in the country is available on Apple's Taiwan Apple Pay website.

Italy

Apple Pay launched in Italy in May of 2017, following hints of an imminent launch for weeks. Apple Pay works with American Express cards issued by American Express, and Visa and MasterCards issued by Carrefour, UniCredit, Banca Mediolanum, ING, and others.

Apple Pay works in retail stores that accept contactless payments, with a list of partners available on Apple's Italian Apple Pay website.

Denmark

Apple Pay launched in Denmark in October of 2017. Jyske Bank (Visa debit cards only), Arbejdernes Landsbank, Spar Nord, Nordea, and Danske Bank support Apple Pay in Denmark. Apple Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay can be found on Apple's Apple Pay website in Denmark.

Finland

Apple Pay launched in Finland in October of 2017.In Finland, credit and debit cards from Nordea, Aktia, and ST1 work with Apple Pay. Apple Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay can be found on Apple's Finland Apple Pay website.

Sweden

Apple Pay launched in Sweden in October of 2017. In Sweden, credit and debit cards from Nordea, Swedbank, and ST1 work with Apple Pay. Apple Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay can be found on Apple's Apple Pay website in Sweden.

United Arab Emirates

Apple Pay launched in UAE in October of 2017. In the United Arab Emirates, several banks are supporting Apple Pay, including Emirates Islamic (Visa credit, debit, and prepaid cards), Emirates NBD, HSBC (Visa and Mastercard credit and debit cards), mashreq, RAKBANK (Mastercard credit, debit, and prepaid cards), and Standard Chartered Bank.

Apple Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay can be found on Apple's UAE Apple Pay website.

Brazil

Apple Pay expanded to Brazil in April of 2018 through a partnership with Brazilian bank Itaú Unibanco. Apple Pay can be used with credit and debit cards issued by Itaú Unibanco in retail stores where NFC payments are accepted and within apps.

Apple Pay in Brazil is acccepted in several retail stores, including Starbucks, Taco Bell, Cobasi, Bullguer, Fast Shop, and more, with a full list of locations available on Apple's Apple Pay website in Brazil.

Ukraine

Apple Pay became available in Ukraine on May 17, 2018. The service works with credit and debit cards issued by PrivatBank at the current time, with Oschadbank planning to add support for Apple Pay in the future.

Poland

Apple Pay launched in Poland on June 18, 2018, and it works with Visa and Mastercard credit and debit cards issued by the following banks: BGZ BNP Paribas, Bank Zachodni WBK, Alior Bank, Raiffeisen Polbank, Nest Bank, mBank, Bank Pekao, Bank Millennium, and Getin Bank.

Norway

Apple Pay launched in Norway on June 19, 2018, and it works with Visa and Mastercard credit and debit cards from Nordea and Santander Consumer Finance.

Belgium

Apple Pay launched in Belgium in November 2018 through an exclusive partnership with BNP Paribas Fortis and its subsidiary brands Fintro and Hello Bank. Customers of these banks are able to use Apple Pay to make payments for purchases online, in apps, and in retail locations that support contactless payments. Apple Pay availability later expanded to KBC in 2020, and ING Belgium in 2021.

Kazakhstan

Apple Pay launched in Kazakhstan in November 2018. Apple Pay is available to Visa and Mastercard credit and debit card holders in Kazakhstan who bank with Eurasian Bank, Halyk Bank, ForteBank, Sberbank, Bank CenterCredit, and ATFBank.

Germany

Apple Pay launched in Germany on December 10, 2018, with the service available through American Express, Deutsche Bank, Viabuy, Consorsbank, Hanseatic Bank, HypoVereinsbank, Edenred, Comdirect, Fidor Bank, Sparkasse, Sparkassen-Card, Commerzbank, and mobile banks and payment services o2, N26, bunq, and VIMpay.

Apple Pay in Germany can be used at retailers that include Aldi, Burger King, Lidl, McDonalds, MediaMarkt, Pull&Bear, Shell, Starbucks, Vapiano, and many more locations, as listed on Apple's Apple Pay site for Germany.

Saudi Arabia

Apple Pay launched in Saudi Arabia on February 19, 2019. It is available for Visa and Mastercard holders that bank with Al Rajhi Bank, NCB, MADA, Riyad Bank, Alinma Bank, and Bank Aljazira.

A list of locations where Apple Pay can be used in Saudi Arabia is available on the Apple Pay website for Saudi Arabia.

Czech Republic

Apple Pay launched in the Czech Republic on February 19, 2019. Apple Pay in the country works with Air Bank, Česká spořitelna, J&T Banka, Komerční banka, MONETA Money Bank, mBank, and payments service Twisto.

A list of locations where Apple Pay is accepted in the Czech Republic can be found on Apple's Apple Pay website for the country.

Austria

Apple Pay became available in Austria in April 2019. Erste Bank, Sparkasse, N26, Bank Austria, and Raiffeisen Bank support Apple Pay in Austria, so customers from these banks can add their credit and debit cards to the Wallet app for use with Apple Pay.

A list of locations where Apple Pay is accepted in Austria can be found on the Austrian Apple Pay website.

Iceland

Apple Pay launched in Iceland in May 2019, allowing customers who bank with Landsbankinn and Arion banki to use their credit and debit cards with the Apple Pay service to make contactless payments.

Hungary

Apple Pay launched in Hungary in May 2019, allowing OTP Bank customers use Apple Pay with their credit and debit cards. A list of locations where Apple Pay can be used in Hungary is available via Apple's Apple Pay website in the country.

Luxembourg

Apple Pay launched in Luxembourg in May 2019, allowing BGL BNP Paribas customers use Apple Pay with their credit and debit cards. At this time, BGL BNP Paribas is the sole bank supporting Apple Pay. A list of locations where Apple Pay can be used in Luxembourg is available via Apple's Apple Pay website in the country.

The Netherlands

Apple Pay launched in The Netherlands in June 2019, allowing customers of ING, Bunq, Monese, N26, Revolut, ABN AMRO, Rabobank, and De Volksbank (parent company of SNS, ASN Bank, and RegioBank), to make Apple Pay purchases with debit and credit cards.

Apple Pay can be used in The Netherlands with several online and high street retailers including Adidas, ALDI, Amac, ARKET, BCC, Burger King, Capi, cool blue, COS, Decathlon, Douglas, H&M, Jumbo, Lidl, McDonalds, Starbucks, and others, with a full list available on Apple's Apple Pay website for The Netherlands.

Georgia

Apple Pay expanded to the country of Georgia in September 2019. It is available to Bank of Georgia credit card holders.

Major European Expansion

In June of 2019, Apple Pay expanded to multiple European countries including Bulgaria, Croatia, Cyprus, Estonia, Greece, Latvia, Liechtenstein, Lithuania, Malta, Portugal, Romania, Slovakia, and Slovenia.

Apple Pay works with a number of popular banks in these countries, with details available for each country on Apple's website.

Serbia

Apple Pay launched in Serbia in June 2020, allowing Mastercard users who bank with ProCredit to add their cards to the Wallet app for contactless Apple Pay payments.

South Korea

Apple is in the early stages of discussions to bring Apple Pay to South Korea, but it may still be some time before the service launches in the country. Because NFC terminals are not common in South Korea, Apple needs to encourage more retailers to implement NFC support.

Israel

Apple Pay launched in Israel in May 2021, and all bank and credit card companies in the country support Apple Pay. Not all credit cards are supported, however.

Bank Hapoalim, Bank Leumi, Bank Massad, Discount Bank, The First International Bank Group, ICC-CAL, Isracard, Pepper Bank, MAX, Mercantile Bank, and Mizrahi-Refahot support Apple Pay.

Mexico

Apple Pay launched in Mexico on February 23, allowing Citibanamex, Banorte, HSBC, and Inbursa customers with American Express and MasterCard debit and credit cards to use Apple Pay in the country when making contactless payments.

Many stores in Mexico support Apple Pay, including 7-Eleven, Petco, PF Changs, Xcaret, and more, with a full list available on the Apple Pay Mexico website.

South Africa

Apple Pay launched in South Africa in March 2021. Apple Pay is available for Discovery, Nedbank, Absa, and FNB customers in the country.

Qatar

Apple Pay launched in Qatar in August 2021, and it is available with the QNB Group, the largest financial institution in the Middle East and Africa. QNB Bank users in the country can use Apple Pay in Qatar, and Apple Pay is also available for Dukhan bank users.

Chile

Apple Pay expanded to Chile in September 2021, and it is available to Banco de Chile and Banco Edwards customers who have Visa cards.

Bahrain

Apple Pay expanded to Bahrain in October 2021, and it is available customers with an eligible credit or debit card.

Palestine

Apple Pay expanded to Palestine in October 2021, and it is available customers with an eligible credit or debit card.

Colombia

Apple Pay launched in Colombia in November 2021. Bancolombia customers can add their Visa and Mastercard credit and debit cards to the Wallet app to make Apple Pay purchases.

Azerbaijan

Apple Pay launched in Azerbaijan in November 2021 for those who bank with Bank Respublika, Unibank Sanin, ABB, and Kapital Bank, allowing card holders to make purchases through Apple Pay.

Costa Rica

Apple Pay came to Costa Rica in November 2021, with major banks that include BAC, BCR, Scotiabank, and Promerica offering support.

India

Apple was working on expanding Apple Pay to India, but plans for the payments service in the country have been shelved for the time being due to regulatory issues and technical problems. The Reserve Bank of India requires companies to store payments data for local users in India, which has led to uncertainties about Apple Pay's rollout in the country. There is no word on when Apple Pay will come to India.

Competition

Walmart, the biggest retailer in the United States has refused to implement Apple Pay and has instead rolled out its own proprietary payment system, Walmart Pay. With Walmart Pay, customers can make purchases and payments in Walmart retail locations using a QR code in the Walmart app. Walmart Pay is available nationwide at all Walmart locations.

Other Apple Pay competitors include Samsung Pay and Google Pay (formerly known as Android Pay), two mobile payment solutions created by Samsung and Google, respectively. These payment solutions are largely designed for Android devices, but even iPhone users can use Google Pay Send for sending money to friends.

How To Change Payment Method On Iphone 6 Plus

Source: https://www.macrumors.com/roundup/apple-pay/

Posted by: stephanunniburd.blogspot.com

0 Response to "How To Change Payment Method On Iphone 6 Plus"

Post a Comment