What Is Money Is Sent To Wrong Routing Number

It's advertised every bit a safe and reliable way to move money, but an Ontario couple says the $10,000 wire transfer they sent their adult son in Alberta was deposited into the wrong account, and then disappeared. An expert says Canada's wire transfer system is flawed and prone to errors.

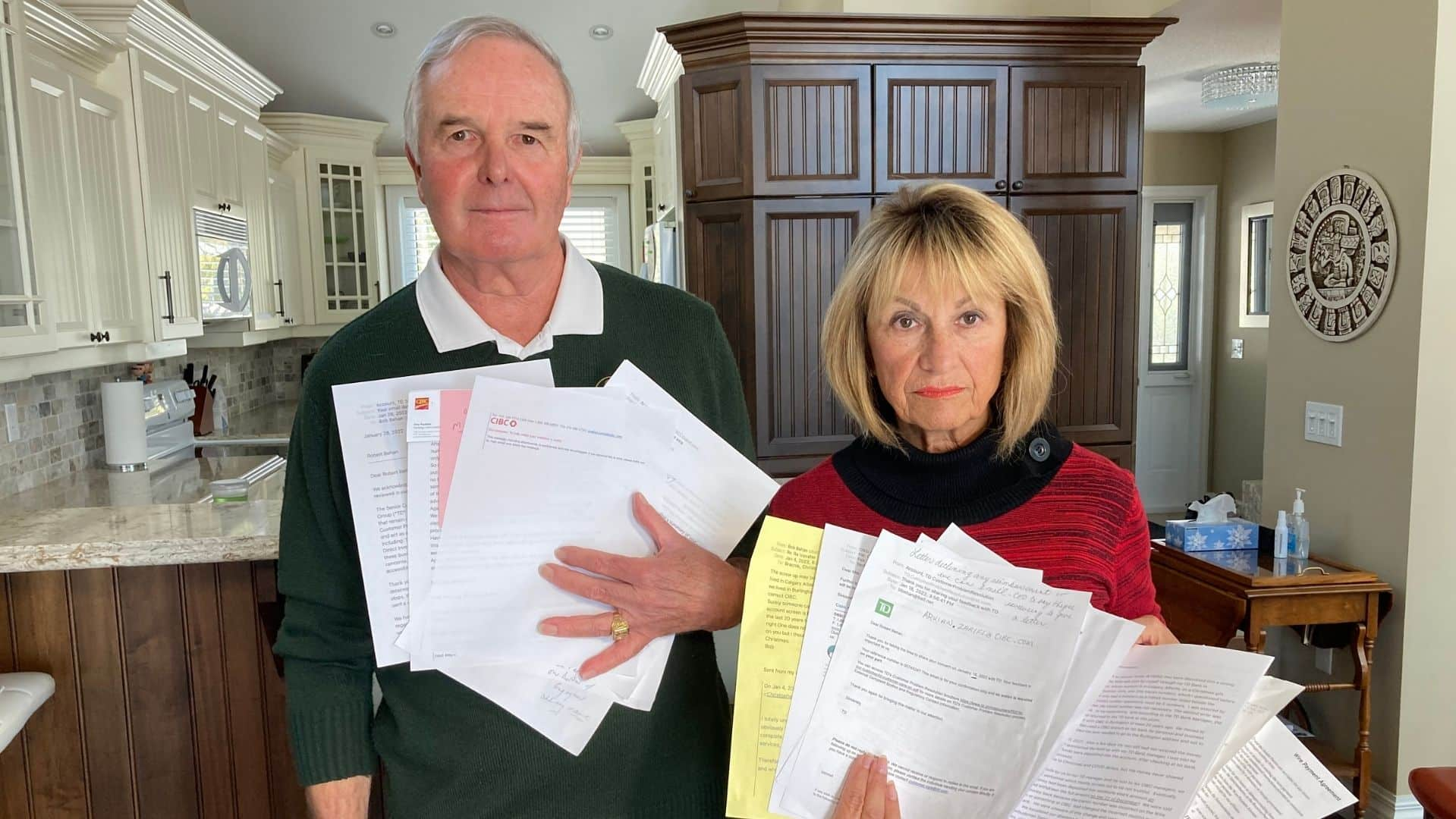

It's advertised as a safe and reliable way to send coin, but an Ontario couple says the $ten,000 wire transfer they sent their adult son was deposited into a stranger's account, and then disappeared. Barbara and Robert Behan wanted to assist their son and his young family finish the basement in their home, so they sent the cash every bit a Christmas gift. The transfer was sent from the couple's TD Bank account in Penetanguishene, Ont., on December. 21, to a CIBC branch in Calgary where their son has been banking for decades. Merely the money never showed up in his account. Weeks after, CIBC told the Behans the money was gone — deposited into someone else'southward account the day it was sent — and that the account holder had withdrawn all $10,000 the next day, and so close the account down. "It's inconceivable. Apparently this person had the exact aforementioned account number equally our son," Barbara said. "But they [CIBC] never matched the name of the account number to our son's name. They just put it into the wrong person's account. Nobody checked it." CIBC says clients can have identical account numbers. Information technology's some other set of numbers — the v-digit transit numbers that identify a specific branch — that differentiates between accounts. All of this could have been prevented if banks had a better arrangement in identify to make certain wire transfers cease up in the right place, says cyberbanking expert Werner Antweiler. "It actually points to the [issues] with the current system," said Antweiler, an associate professor at the Sauder Schoolhouse of Business at the University of British Columbia. "A simple mistake can go compounded very speedily because in one case the money has left an account, it is not like shooting fish in a barrel, or information technology's often impossible, to recollect it … so that'southward really imperative to get the transfer information correct." Later on two months of battling the banks, CIBC's ombudsman decided the banking company was not at fault simply offered the couple one-half of their money dorsum as a goodwill gesture. The banking company returned the entire amount after Go Public contacted it. Spotter | Wire transfer goes missing: Until then, the Behans say they spent "many sleepless nights" wondering if they'd ever encounter their money again. "I worried constantly. I said to all the bank managers and everybody nosotros've been in bear on with, 'If this was your $10,000, would you exist so laid-back nigh it?' It'south $10,000. Information technology'due south not a $i.fifty. It's hard-earned money," Barbara said. The couple says they were bounced back and forth betwixt the ii banks, with neither taking responsibleness. TD told the couple the missing funds were CIBC's fault — because it put the money into someone else'south account afterwards TD had successfully transferred information technology. CIBC'southward ombudsman blamed the Behans, telling them that, instead of providing the transit number for their son's Calgary branch, they should accept given TD the one for the Burlington, Ont., location where he first opened his account decades ago. The ombudsman also said the banking company is attempting to compensate the coin from the other account holder, "through legal activeness." "We encourage clients to double-check this information when sending payments to ensure the funds are delivered to the intended recipient," wrote CIBC spokesperson Trish Tervit in an email to Go Public. The couple says whatever problem should have been flagged and the money returned. "It never should have reached the betoken that it did," Barbara said. Such errors are a direct effect of Canada's flawed wire transfer arrangement, says Antweiler — a system, called Lynx, that's prone to mistakes even though information technology was launched just last September. The majority of banks operating in Canada use Lynx, including CIBC, with a few exceptions. "There are a great number of errors that happen when forms are filled out [and] the slightest fault can lead to these kinds of situations where people are out of pocket, frequently quite deeply out of pocket," he said. Lynx is just used in Canada. It'south owned and operated by the non-turn a profit Payments Canada, which is governed by organizations including the chartered banks and the Bank of Canada. It's in charge of near all the systems (including debit, cheques and wire transfers — only not credit cards) used to make payments or otherwise send money. More than eleven meg transactions valued at $126 trillion were processed betwixt financial institutions in 2021, including international payments, according to Payments Canada. Lynx doesn't require banks to lucifer the account number with the proper name of the business relationship holder — and Antweiler says nigh banks don't — which increases the risk of errors like what happened to the Behans. "Nosotros need to permit Canadians to transfer money more easily from bank to bank … a system that is not every bit error-prone, where if a few characters are wrong, the money ends upward in the wrong place," he said. Lynx replaced the Big Value Transfer Organization (LVTS) that had been in place for more than 20 years, co-ordinate to the Payments Canada website. It calls Lynx "another milestone in payments innovation." At that place is a solution, says Antweiler, pointing to other countries that use the International Banking company Business relationship Number (IBAN) system. Unlike Lynx — which uses a three-digit bank code, a 5-digit transit code and the account number — IBAN uses a lengthy alphanumeric code that allows its built-in error detection to flag problems, leaving little room for homo error. "That means if there's any error, like a number transposed or digit missing, [the transfer] would non work," Antweiler said. As of January, 79 countries were using the IBAN arrangement, including countries in the Eu, Middle East, North Africa and the Caribbean. Get Public asked five of Canada's major banks, Finance Canada and Payments Canada for statistics on wire transfer errors, only none fabricated the information available. The Behans say a safer, more reliable system is needed. "We discovered during this time that our cyberbanking organization, our banks, do not talk to each other. They practise non piece of work together. They don't have the same wire transfer forms. They don't communicate dorsum and forth," Robert said. GO PUBLIC Go Public Get Public "The thing we are maxim is, how are [the banks] going to correct it in the time to come so it doesn't happen to anybody else?" Go Public asked Payments Canada about the problems with Lynx and if it's considering irresolute to the IBAN organization, but it didn't answer the questions. Become Public is an investigative news segment on CBC-Tv, radio and the web. We tell your stories, shed light on wrongdoing and concur the powers that be accountable. If you take a story in the public interest, or if you're an insider with information, contact GoPublic@cbc.ca with your name, contact data and a brief summary. All emails are confidential until yous decide to Go Public. Follow@CBCGoPublic on Twitter. Read more than stories past Go Public.

'Many sleepless nights'

Prone to errors

Submit your story ideas

Source: https://www.cbc.ca/news/business/wire-transfer-disappears-banks-1.6401776

Posted by: stephanunniburd.blogspot.com

0 Response to "What Is Money Is Sent To Wrong Routing Number"

Post a Comment