How To Get Free Money From Atms

How To Discover No-Fee Free ATMs Near You

- In-Network vs Out-of-Network

- Finding ATMs With No Fees

- Banks with No Fee ATMs

- Other Ways To Avert Paying ATM Fees

- Final Take

anandaBGD / Getty Images

These days, you lot can pretty much find automated teller machines, or ATMs, anywhere y'all go. Businesses make money when people pay a fee to apply ATMs in their location. In the U.S., these fees typically range between $2 and $v and tin can be fifty-fifty more than plush abroad.

If you're looking for means to avoid paying ATM fees, proceed reading to observe free, no-fee ATMs near you lot.

In-Network vs. Out-of-Network ATMs

Banks' ATMs are either in-network or out-of-network. On average, yous'll pay up to $5 to use an out-of-network ATM. If you're overseas, international ATM withdrawal or foreign transaction fees will cost you even more.

To avoid paying these extra fees when you desire to withdraw your money, yous'll need to find ATMs that are within your financial establishment'due south network. In-network ATMs are usually free to utilise for banks' customers.

Advice

Out-of-network ATMs tin can hit you with 2 fees. Your bank tin can charge you an out-of-network fee, and the ATM'southward owner or bank could charge you lot another fee to utilise that machine. Attempt to use only ATMs within your banking system and relieve some money.

Nearly all banks have website and mobile app ATM locators, so finding a no-fee ATM location near you is easy to do.

Tips for Finding ATMs that Don't Charge Fees

It'southward easy to find free, in-network, no-fee ATMs whether you're at home or on the become.

1. Choose an ATM at one of your bank's locations.

If you banking company with a brick-and-mortar institution, get to one of its physical locations to use the ATM. Information technology's wise to do business organization with a fiscal institution that has several nationwide co-operative locations.

2. Utilize your banking concern's website or mobile app to discover in-network ATM locations nigh you.

A little planning can get a long way in saving you from paying ATM surcharges at an out-of-network location. To have all of your bank's in-network locations at your fingertips, be certain to download the bank'south app on your mobile device.

It'south prudent to cheque for these locations in advance so that you'll know exactly where to become when you're out and almost, especially in an unfamiliar expanse.

3. Find out if your bank is part of a surcharge-complimentary ATM network.

Some financial institutions have agreements with no-fee ATM networks in which customers tin can use these ATMs without incurring fees. You can discover out if your bank participates in a surcharge-gratuitous ATM network by visiting or calling a branch office or searching the bank'due south website or mobile app.

Here'south a list of some pop, surcharge-gratis ATM networks and the number of participating ATMs nationwide and worldwide.

Best Banks with No ATM Fees

| No-surcharge ATM Network | Number of ATMs Nationwide and Worldwide |

|---|---|

| Allpoint | Over 55,000 worldwide |

| MoneyPass | More than 37,000 nationwide and in Puerto Rico |

| Plus Alliance Network | Thousands nationwide |

| PULSE | 500,000 worldwide |

| SUM | Thousands nationwide |

| TransFund | Thousands nationwide |

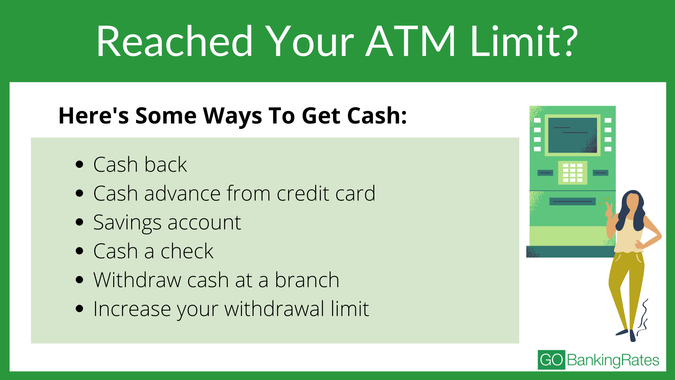

Other Ways To Avert Paying ATM Fees

In addition to using your bank or credit union's ATMs, there are other ways you can access your cash without having to pay ATM fees. Hither are some options to consider.

1. Make purchases and become cash back.

When purchasing items at the supermarket, pet store, gas station or other retail stores, you can ask for free cash back before your debit menu is charged. The extra amount is added to your total sale price at no additional charge.

Typically, most retailers volition allow you to go betwixt $twenty and $100 cashback over your purchase price. Using this cash-dorsum method will toll you nothing as opposed to paying extra fees to utilise an out-of-network ATM.

2. Get familiar with affiliate banks when yous travel.

While away, check to see if there's a banking company affiliated with your U.S. bank. Before leaving for your trip, enquire your financial institution to provide you with a list of surcharge-complimentary, foreign affiliates at your travel destination. Past doing this, y'all tin can avoid paying a foreign ATM fee every bit well as the surcharge, saving you sometimes up of $5.

3. Get a no-fee checking account.

Some banks offer premium checking accounts with no fees for ATM withdrawals no thing where you are. An example is Chase, which has ii complimentary checking account options for no-fee ATM withdrawals at not-Chase locations. These accounts are:

- Hunt Premier Plus — allows 4 gratis, no-fee ATM withdrawals

- Chase Premier Platinum Checking — allows unlimited, free, no-fee ATM withdrawals

Be aware that these accounts may come with high monthly maintenance fees to have advantage of this perk. Be sure that yous can meet the monthly requirements to waive the fee.

4. Find an online banking company that will reimburse ATM surcharges.

Since online banks don't have physical locations or ATMs, most of them will reimburse all ATM surcharge fees for their customers. You typically only need to have a basic checking account to exist eligible for this ATM fee reimbursement do good.

Pro Tip

If you use the Cash App payment app, you tin apply your Greenbacks App Cash Carte du jour and PIN to make ATM withdrawals for costless at any ATM. Only, there's a catch. You must have at least $300 from your paycheck directly deposited into your Cash App account each month.

Afterward you lot have successfully activated the free ATM withdrawal option on your account, yous volition get an additional 31 days of free ATM fee reimbursements.

Final Accept

You lot now are familiar with unlike ways of finding complimentary, no-fee ATMs near you lot. To recap, follow these elementary guidelines and stop paying surcharges and fees to withdraw your hard-earned coin from ATMs wherever you are.

Takeaways

- Stay within your bank'southward network.

- Utilise your bank's website or mobile app to locate ATMs inside your bank's network.

- Get a checking account that waives ATM withdrawal fees.

- Always be enlightened of what fees your depository financial institution charges for ATM withdrawals.

- If all else fails, carry some cash and avert ATMs altogether.

This data is authentic as of Mar. 23, 2022.

Source: https://www.gobankingrates.com/banking/banks/banks-no-fee-atms/

Posted by: stephanunniburd.blogspot.com

0 Response to "How To Get Free Money From Atms"

Post a Comment